Being an overly cautious sort, I’ve been reluctant to jump the gun in sharing some exciting news. Explaining just how meaningful this is will require a more introspective post in the future, because personal finance is a subject that — to the amusement of some and confusion of others — I’m quite passionate about. My aversion to debt is such that nine years ago, when someone close to me learned my new girlfriend was on the hook for around a quarter-million dollars in student loans, they replied “HAHAHAHA.”

However stressful I found that debt to be (and as a low earner whose first house cost only a fraction of Crankenstein’s education, I found it hellaciously stressful), it was infinitely more distressing to her. In March of 2015 she told me “I remember my financial aid exit interview: ‘These loans will persist even through bankruptcy. They can only be discharged by payment… or if you die.’ It was a cheery conversation.”

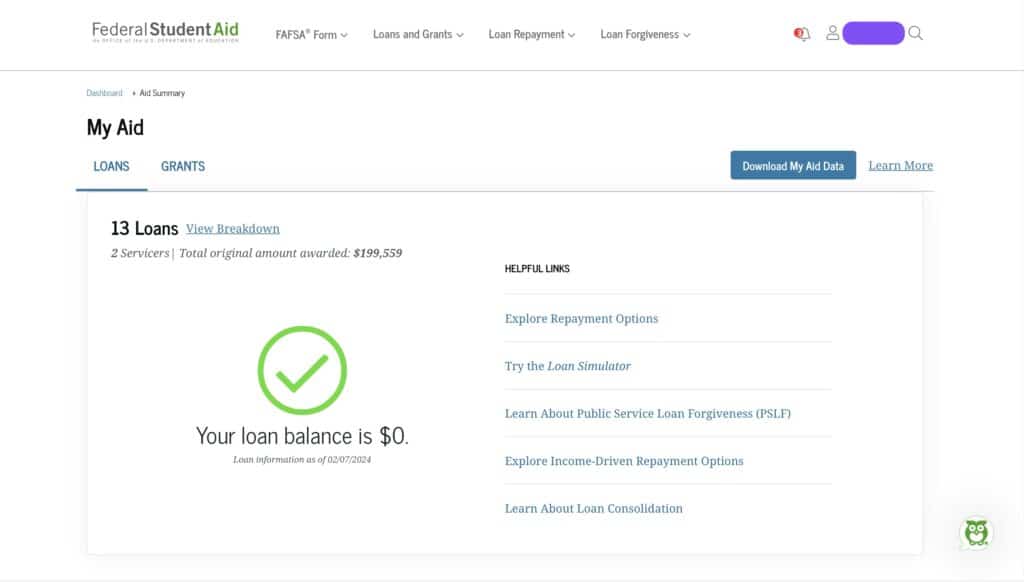

That quote was immediately jotted in my notes for posterity. Since then it has served as both a reminder and a challenge: if our relationship went the distance I wanted Crankenstein’s loans, a mixture of federal (screenshot below) and private, gone by the time I turned 40. We missed the mark on that one, but 41 ain’t bad. For the first time in her adult life, Crankenstein carries no education-related debt. Our financial future belongs to us now, not her lenders.

It still doesn’t feel real. We might have nightmares for the rest of our lives in which resurrected student loans pursue us like something from a George A. Romero movie as reimagined by CNBC — zombies feasting not only on brains but bank accounts. While we pinch ourselves or wait for an “Oops, we miscalculated and you owe us a trillion dollars” letter from her loan servicer, I keep thinking of a George Michael lyric: “You gotta give for what you take.” And that reminds me of cable TV, which we don’t have as cord-cutters.

My parents splurged on basic cable in the mid-’90s, when I was around 12 years old. It came with VH-1 (later VH1) and MTV, and since the internet wasn’t the internet yet, my brother Felix and I gleefully set about rotting our brains with it. At an introductory cost of $29.99 per month — adjusted for inflation, that’s $61 today — it was a significant expenditure, as we were frequently reminded; it would’ve been disrespectful not to watch music videos whenever the TV remote was ours.

Felix, a budding ladies’ man, naturally declared his crushes on the singers, models and actresses who paraded across the screen. He wanted to see the Rembrandts’ video for the Friends theme song because of his love for Courteney Cox, and was smitten as Lisa Loeb sang “Stay (I Missed You)” to an empty apartment. Privately, I agreed that Loeb was cute — who doesn’t like a neurotic brunette? But I was still too oblivious to recognize my crushes for what they were, and wasn’t comfortable expressing my jumbled thoughts to anyone else, even Felix.

Once I figured that out, my favorite videos from those early, heady days of finally having cable made more sense: Sade’s “No Ordinary Love,” Aerosmith’s “Crazy,” and above all else, George Michael’s “Freedom! ’90.” Felix, partial to gamines, was lovestruck by Christy Turlington but anguished by the strategically placed arms in Cindy Crawford’s bathtub scene. I shared his frustration and hated Richard Gere for a few years afterward. Naomi Campbell also drew my attention, possibly because — in an early sign of my questionable judgment and penchant for live wires — I already sensed she was capable of throwing a phone at someone’s head.

Maybe that’s how I’ll kick off my ‘sayonara to student loans’ celebration, by watching “Freedom! ’90” and poorly singing along. In a nod to giving for what you take, it took us throwing everything and the kitchen sink at Crankenstein’s loans over the years and unexpected partial forgiveness under the expanded PSLF waiver to clear the last of the debt.* She qualified because of her ongoing commitment to public service, but she plans to give back in other ways as well. Her biggest long-term financial goal now is to fund an endowed scholarship that allows others to graduate from medical school debt-free.**

* Since forgiveness wasn’t an option pre-waiver, we spent years throwing extra money at the loans. But compound interest at a high rate was killing us. Though we flirted with refinancing to a lower rate, we were concerned about the possibility of discharge in the event Crankenstein was ever disabled and could no longer practice medicine. Normally you’d mitigate that risk by purchasing own-occupation insurance, which pays more than employer disability policies. That’s not an option for us due to Crankenstein’s history of depression and eating disorder. We were financially trapped by her health, a familiar situation to anyone dealt a lousy medical hand.

** My immediate financial goal is to increase our retirement savings. But after nine years of putting many things on hold to tackle the student loans, there’s a lot we need to (slowly) catch up on. I’ll write a separate post about that eventually because it will offer some insight into our values and priorities. Long-term, I want to make meaningful financial contributions to IBD and MS research. There are also some museums, libraries and other community organizations we want to support to a greater extent than what we’ve managed so far. But we have to balance all of that with the expectation that we might need to financially help our parents or Felix one day.